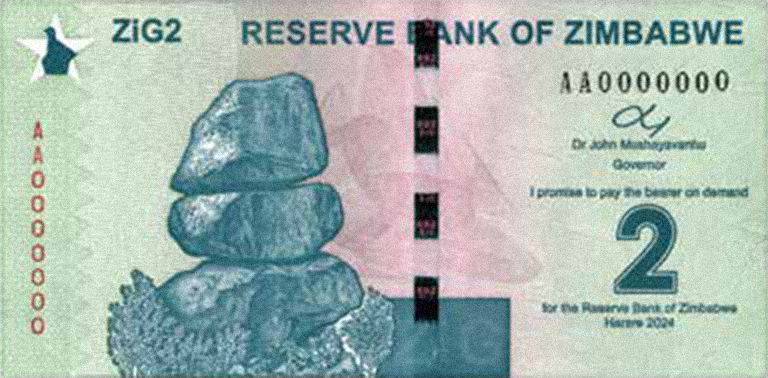

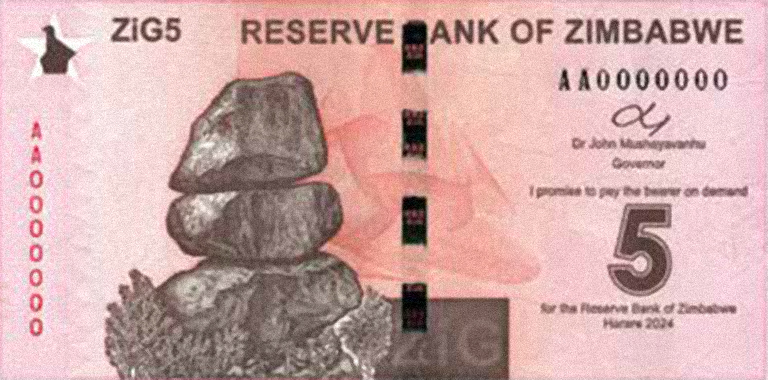

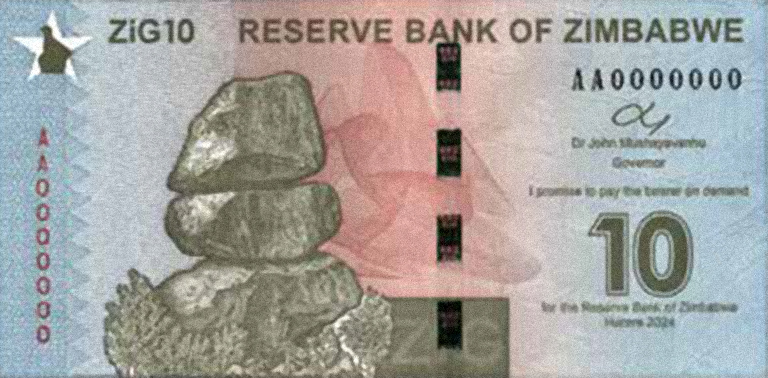

John Mushayavanhu, Governor of the Reserve Bank of Zimbabwe, announced today the creation of a new currency, the ZiG (Zimbabwe gold), and the issue of a new family of banknotes.

This new currency will be backed by a basket of foreign currencies, gold and other precious metals.

The ratio between ZiG and current ZWL banknotes is 13.56/1. Banks were instructed to convert all account to the new currency on 8 April. All obligations are to be converted at the same rate.

About 80% of all transactions are conducted in U.S. dollars, which will continue to be used. The multicurrency system is to continue in use until 2030, as per law.

All banks must accept the old current notes for 21 days.

The banknotes to be issued are the 1 ZiG (ZiG1.1); 2 ZiG (ZiG2.1); 5 ZiG (ZiG5.1); 10 ZiG (ZiG10.1); 20 ZiG (ZiG20.1); 50 ZiG (ZiG20.1); 100 ZiG (ZiG100.1); 200 ZiG (ZiG200.1).

The legal basis for this is the “Presidential Powers, Temporary Measures) (Zimbabwe Gold Notes and Coins) regulations, 2024”.

Source: newzimbabwe.com

Photos, courtesy of Antje Bird.

Order the MRI BANKERS’ GUIDE TO FOREIGN CURRENCY.

©2024 MRI BANKERS’ GUIDE TO FOREIGN CURRENCY™. All rights reserved.

« More posts